Today I’d like to take you back in time. Back more than 30 years, in fact. Imagine that it’s 1991. It’s the early days of the PC industry, and Bill Gates has invited you out to his family’s summer home for the Fourth of July.

Today I’d like to take you back in time. Back more than 30 years, in fact. Imagine that it’s 1991. It’s the early days of the PC industry, and Bill Gates has invited you out to his family’s summer home for the Fourth of July.

It’s a small gathering, which is great because you’ll be able to spend hours one-on-one with Gates. He’s just thirty-five at the time but already a well known industry leader. You know that Microsoft is growing quickly, but you don’t use a PC yourself, and you’re not sure if you need one. Also, thinking as an investor, you know that Microsoft is a public company, so you’re wondering whether you should at least buy some of their stock. The PC industry is still relatively new, but if there’s anyone in the world who can help you understand it, it’s the person standing right in front of you. He’ll answer any question you want (excluding inside information, of course), and you end up talking for hours.

So, here’s my question: At the end of the day, what do you do? Do you go home and buy some Microsoft stock?

It turns out that this meeting is not just hypothetical. This actually occurred. It was July 5, 1991, and the visitor to Gates’s house that day was the investor Warren Buffett. It was the first time that the two had met. According to Buffett, this is how the conversation went:

Gates: “You’ve got to have a computer.”

Buffett: “Why?”

Gates: “You can keep track of your stock portfolio.”

Buffett: “I only own one stock [Berkshire Hathaway].”

Gates: “Well, you can do your taxes.”

Buffett: “I don’t have any income. Berkshire doesn’t pay a dividend.”

Gates: “It’s going to change everything.”

Buffett: “Will it change whether people chew gum?”

Gates: “Probably not.”

Buffett: “Well, then I’ll stick to chewing gum, and you stick to computers.”

As you might guess, following that meeting, Buffett did not buy a PC, and he didn’t buy any Microsoft stock either. In fact, to this day he has never purchased a single share (though he did later buy a computer).

My question: Did Buffett make a mistake? In hindsight, it certainly looks like a mistake. Since that day in 1991, Microsoft’s share price has risen from $1.29 to nearly $75. But would Buffett characterize it as a mistake?

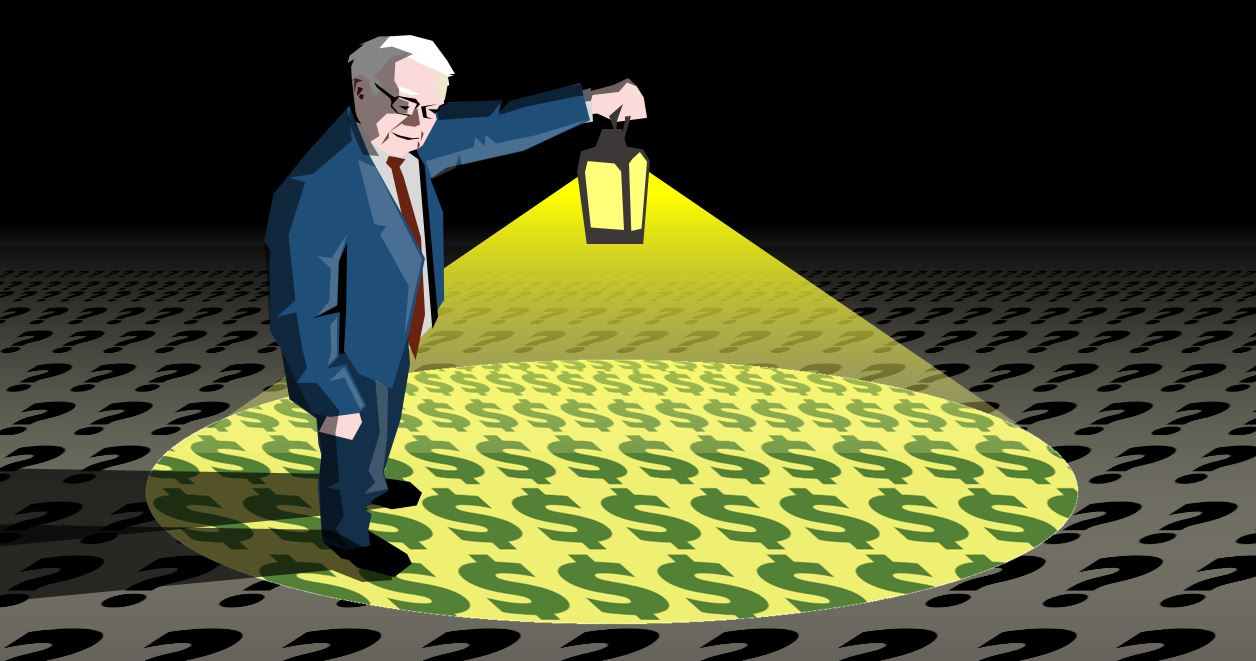

It turns out that Buffett has addressed this question a number of times and explained how he makes investment decisions. He uses a discipline he calls his “circle of competence.” He acknowledges that there are some things that he understands and some things he doesn’t. To avoid making costly mistakes, Buffett sticks to what he knows best. In other words, stays within his circle. Buffett makes no apologies for this, saying: “There’s thousands of opportunities. It’s a terrible mistake to feel you have to have an opinion on everything.”

Now, let’s come back to the question of whether Buffett made a mistake when he took a pass on Microsoft. Did he miss out on a gigantic profit? The answer is undoubtedly yes. But, did Buffett violate his circle-of-competence discipline? Here, the answer is clearly no. Despite the one-on-one lesson from Bill Gates, Buffett concluded that he still wasn’t comfortable with his understanding of Microsoft. It didn’t fit within his circle, and so he chose to stay on the sidelines. Through that lens, I think you’d conclude that Buffett did not make any mistake at all.

What’s the lesson here for you? If you wanted to borrow one thing from Warren Buffett’s approach, this is what I would recommend: Have a plan. Have a logic and a methodology for all of your financial decisions. It doesn’t matter if you’re not running a multi-billion dollar investment fund like he is. You still want to have a well-articulated strategy that guides all of your decisions.

This will look different for each individual, but here’s the overall approach I recommend. It’s five steps: (1) Articulate your goals; (2) Quantify each goal; (3) Attach a time frame to each goal; (4) Develop and implement an investment plan for each goal; (5) Review your plan at least once a year and modify it as your circumstances change.

To be sure, if you deviate from your plan, or if you don’t have a plan at all, you still might get lucky sometimes, just as Buffett might have gotten lucky if he had bought into Microsoft. But success like that is just luck, and luck is not a reliable strategy.

There’s an interesting postscript to this whole story: For some reason, several years ago Buffett decided to step outside his circle and buy a huge stake in IBM. The result was disastrous, and Buffett acknowledged the mistake. Meanwhile, when he stuck to chewing gum, buying a big stake in Wrigley’s, Buffett did very well. Having a plan, and sticking to it, really does matter.